Summary of Policy Tracker study for NL ministry of economic affairs

Study on future trends in radio frequencies and expected usage for 10 years

The Dutch ministry has commissioned a study by a UK based marketing bureau for its long term spectrum policies. The study is broad and internationally oriented hence has significance for a wider audience than just Netherlands. It covers all spectrum usage, so from PMSE to broadcast and from satellite to mobile networks.

For the audience of PRIMMA we pick the chapter that deals with private – so called shared – spectrum for local enterprise networks. The trends disclosed are relevant to all countries.

To put the private market into perspective, the study articulates the rapid growth of the niche yet also points at the fact that total equipment sales in this niche is 0.5% of equipment sales in MNO networks.

Private spectrum

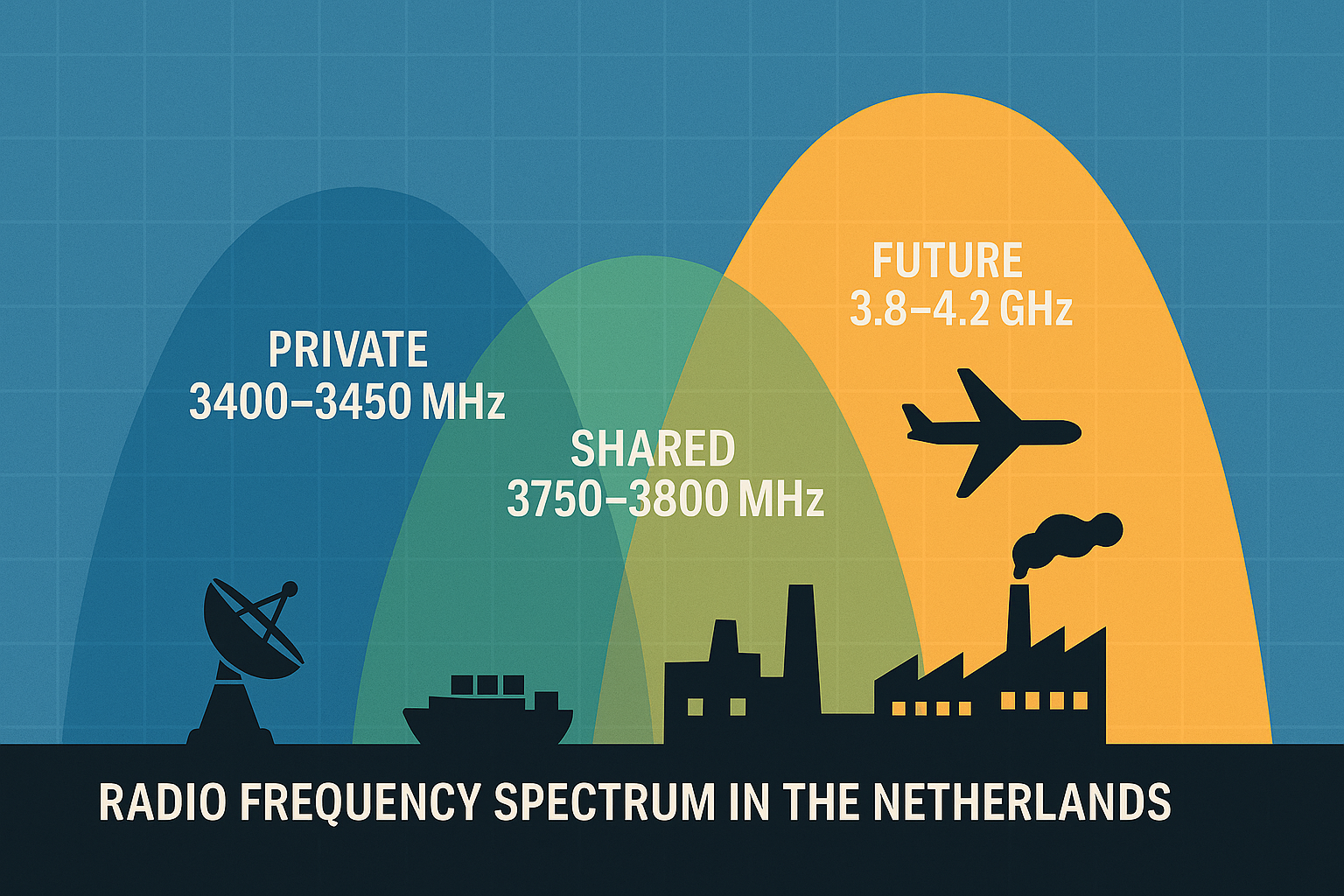

The study identifies 2 bands for private networks in NL:

- The bands 3400-3450 and 3750-3800 Mhz; together allocated for private networks as off 2023 and after a lengthy debate with the sector and MNO’s on how much to allocate and where in b77

- The band 3.8-4.2 Ghz, identified by CEPT and the EU as prospective band for harmonised pan European spectrum for private networks. This band supposedly should go into the accreditation process in all members states as off 2025.

These two combined would deliver 500 Mhz of spectrum – if the 400 Mhz of new spectrum is not contested, it does sit in bands where there are existing users like satellite – which according to the study is more than enough for the current and future expected demand.

Spectrum sufficiency

The study makes some drastic assumptions !At present Holand has some 20 private networks according to the GSA (these numbers are used throughout the study, also the totals deployed that the GSA reports (1800+ as per Q3 2025). The study assumes a drastic 10-fold expansion till 2030 And a 100 fold by 2035. Still the spectrum available would be more than sufficient.

The study assumes an average enterprise network to use 40 MHz and deploy 2 guard bands of 5Mhz. The study then makes a rather sterile calculation on a typical area served by low to mid power spectrum at a campus or enterprise, calculates the frequency reuse and comes up with the stunning number of a potential capacity of 140.000 of these networks in a country the size of Holland. It then mitigates its numbers by taking into account that these private networks are not evenly spread over a country and tend to cluster and then comes up with the number of 56.000 sites that the said spectrum can facilitate. This, so the study , by far exceeds the 100-fold scenario with some 2000 industry private networks.

The study concentrates on low top medium power usage; high power is predominantly envisaged for sites like port of Rotterdam (EU’s largest) and Schiphol airport (EU’s 4th )

Key take away

The study seems to indicate that even with the most drastic growth numbers for private networks, the total allocated spectrum is more than enough. This is reassuring for the private domain; we are not going to run out of spectrum. Yet….,

- This assumes the whole 400 Mhz in 3.8 comes available

- The initial assumption of 20 networks is very low; after years of spectral turmoil and late availability the Dutch private networks deployment has fallen behind

- This numbers exercise ignores the large potential volumes of sites and networks that are likely to emerge when the SME market gets addressed (which it hasn’t been so far)

- This may trigger counter measures from other spectrum users who’d argue that the spectrums set aside is over dimensioned and had better be used otherwise.

So my take would be to stay alert and watch out for deliberate misinterpretations of these estimations…

Koen Mioulet

PRIMMA domain specialist

"IF THE PORT AUTHORITY DOESN’T ACT, COMPANIES WILL HAVE TO DO IT THEMSELVES"

“WE WANT TO ACCELERATE THE MARKET, NOT JUST FOR THE FRONT-RUNNERS, BUT FOR THE ENTIRE INDUSTRIAL ECOSYSTEM”